Organizational Overview

Henry Resources | Oil & Gas

Henry Resources represents the Permian Basin focused oil & gas arm of the Henry companies and is slated to function as the growth engine of the Henry organization. Capital devoted to the acquisition and development of oil & gas assets accounts for the majority of the annual Henry budget. The main goal of the oil & gas team is to grow the company's rate and reserves through the drill bit while maintaining a cash flow neutral spend rate. Henry positions itself to be the end-user of the properties we operate, with the goal of converting all commercial inventory to PDP as efficiently as possible.

We remain acquisitive for high quality assets in both the Midland & Delaware Basins. Henry prefers to operate with approximately 40% working interest and have quality partners own the balance. We place the utmost importance on partnerships with entities that share our values and align with our long-term investment cycle, cash flow neutral spend rate, and low leverage principles.

Henry TAW | Investments

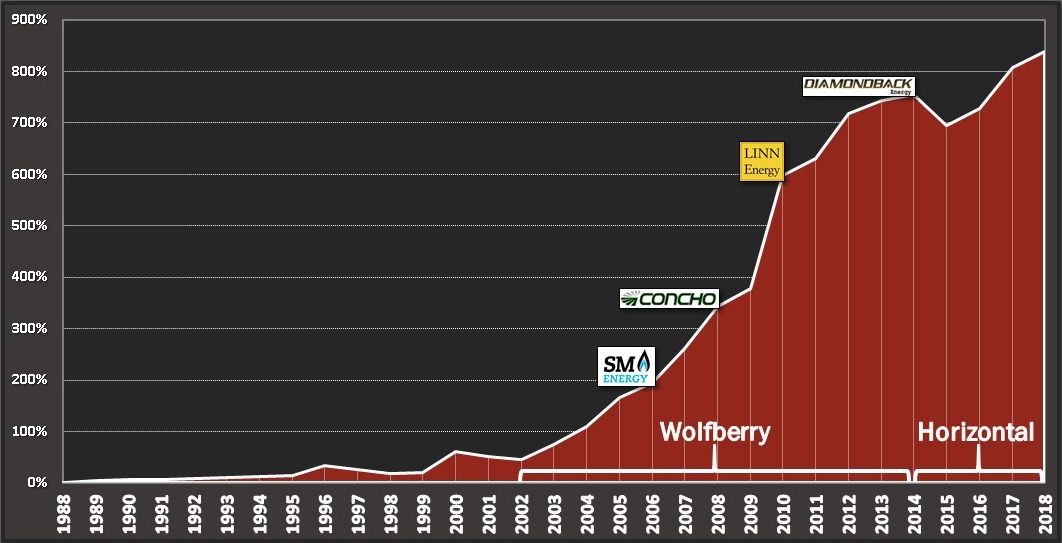

Henry considers itself a long-term player in the oil and gas industry. However, with the liquidity events from the corporate sale to Concho in 2008 and subsequent asset sale to Linn Energy in 2010, the Henry family began the process of diversifying its investments into sectors outside of oil & gas and the Permian Basin. This corporate diversification was carried out to stabilize returns during fluctuating commodity price cycles that will invariably show up in an oil & gas portfolio.

Alternative investments include stocks, bonds, real estate investments, private equity ventures, bank ownership, merchant banking, etc. While oil & gas operations continue to be the primary growth vehicle for the organization, the goal of alternative investments is to reduce the overall risk profile of the company while supporting the shareholders’ value.

Corporate Value Growth | Last 30 Years

CONTACT

3525 Andrews Hwy

Midland, TX 79703

Phone: (432) 694-3000